Handling Cash in your Business. Part Two: Shift Reconciliation

This is the second article in our three-part series 'Handling Cash in your Business', focusing on best practices for your Shift Reconciliation.

We recommend reading through the first article in this series, Handling Cash in your Business. Part One: At the POS, to ensure you are setting yourself up for success from the moment cash enters your business.

Now that we are across correct handling of cash at the Point of Sale, it is time to ensure we are engaging best practices for performing our Shift Reconciliation.

The key to a successful Shift Reconciliation is all in the prep work done prior to even hitting that ‘Reconcile’ Button. Gather together the below list of items and lets get started!

What you need for your Shift Rec:

- All safe drops, including final drops (keep the money separate in money bags, do not bundle it together)

- End of Shift Dockets

- EFTPOS Print Totals for each Shift

- EFTPOS Settlement for each POS

- EFTPOS Settlement for any non-integrated EFTPOS pinpads

- Pump Meters

- Tank Dips

Quick Tips:

- Ensure your Safe Drop cash and Safe Drop printed slip are put together in a Money Bag into the safe.

This keeps the money together with the slip and prevents it getting lost/mixed in with other drops.

*Unless you have a Smart Safe that counts the money as you deposit it - The cash for each shift should be counted SEPARATELY.

This allows you to identify where the cash variance has occurred, reducing the time needed to investigate and also increasing the likelihood of finding out what has happened. - Check your EFTPOS Totals match, particularly for non-integrated EFTPOS

- Taking your Tank Dips and Meter Reads daily ensures you pick up any fuel variances quickly and also increases the likelihood of finding the cause.

- Have your staff print out a copy of any Refunds they do on the POS and write the reason for the refund on the back.

This not only promotes honesty as your staff are aware of you monitoring refunds, it also may point you in the direction of an accidental error. - Utilise the Reconcile Adjust Sales screen to do a daily quick check on any non-integrated digital sales. I.E stand-alone epay terminal or Power Charge/Card sales.

If digital sales are non-integrated it leaves them open to exploitation. By comparing the end of day settlement/print out to the Reconcile Adjust Sales screen each day you can quickly identify any missing sales.

Lets get started - the process

As mentioned earlier a Shift Rec is only as good as your prep work, before doing any reconciliation you should be checking the Print Totals Report

Check the Print Totals Report

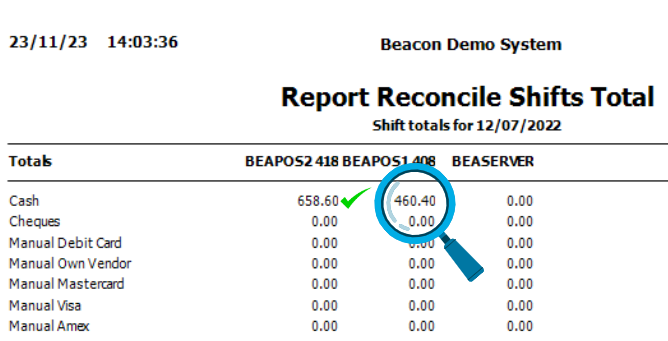

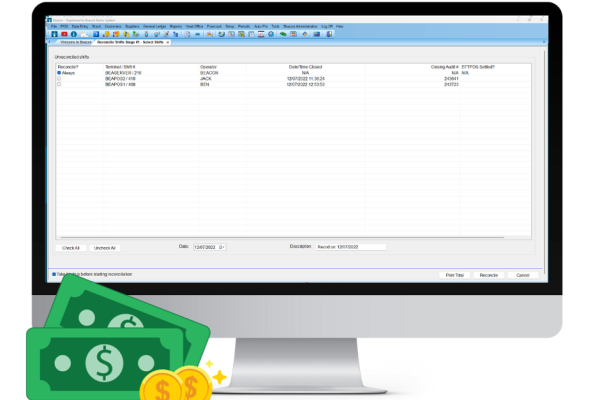

- Open Beacon and Select Reconcile ShiftsSelect the relevant Shifts for the day and click PRINT TOTAL

- Separate your Safe Drop and Final Drop cash and printed slips by shift.

- Do the following for each shift:

- Open each safe drop/final drop and check the amount of cash in the bag matches the Safe Drop ticket printed out of Beacon.

- If it matches put a tick on the paper and move the cash to the pile for that shift, put these aside in case you need to check them.

- Continue on until you have counted all the drops and have a pile of cash for each shift - Count the total cash you have for each shift and compare it to the Cash amount for that shift on the Print totals report, and note down any variances.

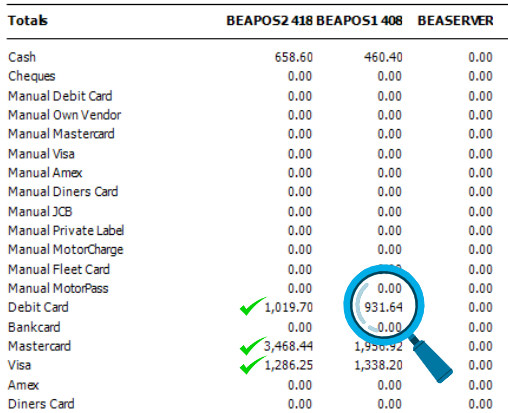

NOTE: Stop here if you have a large or unexpected variance - We will cover investigating variances in the next article of this series - Collect the EFTPOS Print Totals for each shift and check the values for each media type.

NOTE: Stop here if there are any variances and investigate! - We will cover investigating variances in the next article of this series - Add up the total cash you have and note it down for the final stage of the Shift Rec.

Ok, now that we have counted the cash and investigated any cash or media variances, we are ready to start the Shift Reconciliation.

- Select your Shifts and click that Reconcile button!

- DO NOT SKIP the backup!

If you are unsure why backups are important, please read out article “Are you backing up your data correctly?” - Reconcile Adjust Sales

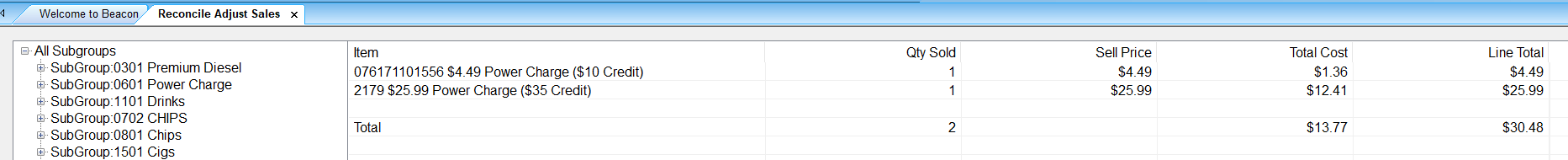

If you have any non-integrated digital sales, for example non-integrated epay or non-integrated Power Charge sales, utilise this screen to quickly check the sales processed in Beacon against the settlement that prints out of these devices.

Expand the Subgroup that your Stock Items are kept in and check this against the totals.

If you find any variances you will need to speak to the staff member involved and ask why these were not processed through the POS. There may be a genuine reason and this item is waiting to be credited or there may have been an oversight.

If the missing sales are genuine, the Shift Reconciliation should be aborted and the sale created in Beacon Back Office. - Reconcile Paid Outs

Ensure that any paid outs are married up with the Tax Invoices and complete them here. - Reconcile Pumps

Enter your Meter reads and ensure they match, if you have a variance stop and investigate. We will cover how to investigate Meter variances in a future article - Reconcile Tanks

Enter/Reconcile any deliveries and enter your Tank Dips.

Fuel does expand and contract under different circumstances so you may find there is a small variance up and down throughout the month, but any large variances or growing variances should be investigated. We will cover how to investigate Dip variances in a future article. - Reconcile Shifts Stage #3

Enter the values you confirmed in the Print Totals Screen and complete your Shift Reconciliation.

Latest Posts

Recoup your Public Holiday Costs with Public Holiday Surcharging

Our new public holiday surcharge feature helps businesses cover increased operational costs and maximize revenue during peak periods.

Ampol DX8000 Pinpad now available with Beacon POS

Having now successfully completed the piloting phase, we're pleased to share that the rollout is set to begin.

New Quest BP EFTPOS Plus Platform now available!

BP, in partnership with Quest Payment Systems, have launched the new and improved Quest BP EFTPOS Platform.

Daysheet Dashboard now available

Providing information such as the daily Sales Data, the breakdown of Fuel and Group sales and also a sales comparison to the same day last year, the Beacon Daysheet Dashboard allows you to keep up with your site's performance from anywhere.

Come see us at the UCB conference 2024

RACV ROYAL PINES RESORT Tuesday 5th - Thursday 7th March 2024

Handling Cash in your Business. Part Three: Investigating a Cash or Media variance

This is the third and final article in our three-part series 'Handling Cash in your Business', focusing on investigating a cash or media variance.

Handling Cash in your Business. Part Two: Shift Reconciliation

This is the second article in our three-part series 'Handling Cash in your Business', focusing on best practices for your Shift Reconciliation.

Caltex Scone is now live and trading!

We are thrilled to celebrate this milestone with one of our longest-standing partners, Pegasus Petroleum.